Buying a home is often seen as a sign of adulthood and financial independence. No longer are you trapped in the never-ending cycle of paying rent without getting any return on your investment. Buying a home also gives you the opportunity to decorate with custom furnishings and unique designs catered to your tastes.

However, for millennials, homeownership is slightly lower than previous generations. We were curious to find out why millennials have been hesitant to purchase a home as well as learn more about those who are ready to become homeowners. In order to tap into the first-time millennial home buyer mindset, we surveyed 2,000 millennials between the age of 22 and 37. Here’s what they had to say about home ownership.

Of our 2,000 survey respondents, 33% currently own a home. In terms of home they paid for their home, 53% paid for the down payment with personal savings, 14% had help from their parents and 20% said they used a combination of financial help from parents and a loan. Only 15% of millennial homeowners said they regret buying their home. The top reasons included maintenance issues, buying it too soon, buying a home that wasn’t large enough, and financial concerns. Many millennial homeowners said they relocated in order to find a better deal on a home. In fact, 30% said they relocated when they bought a new home.

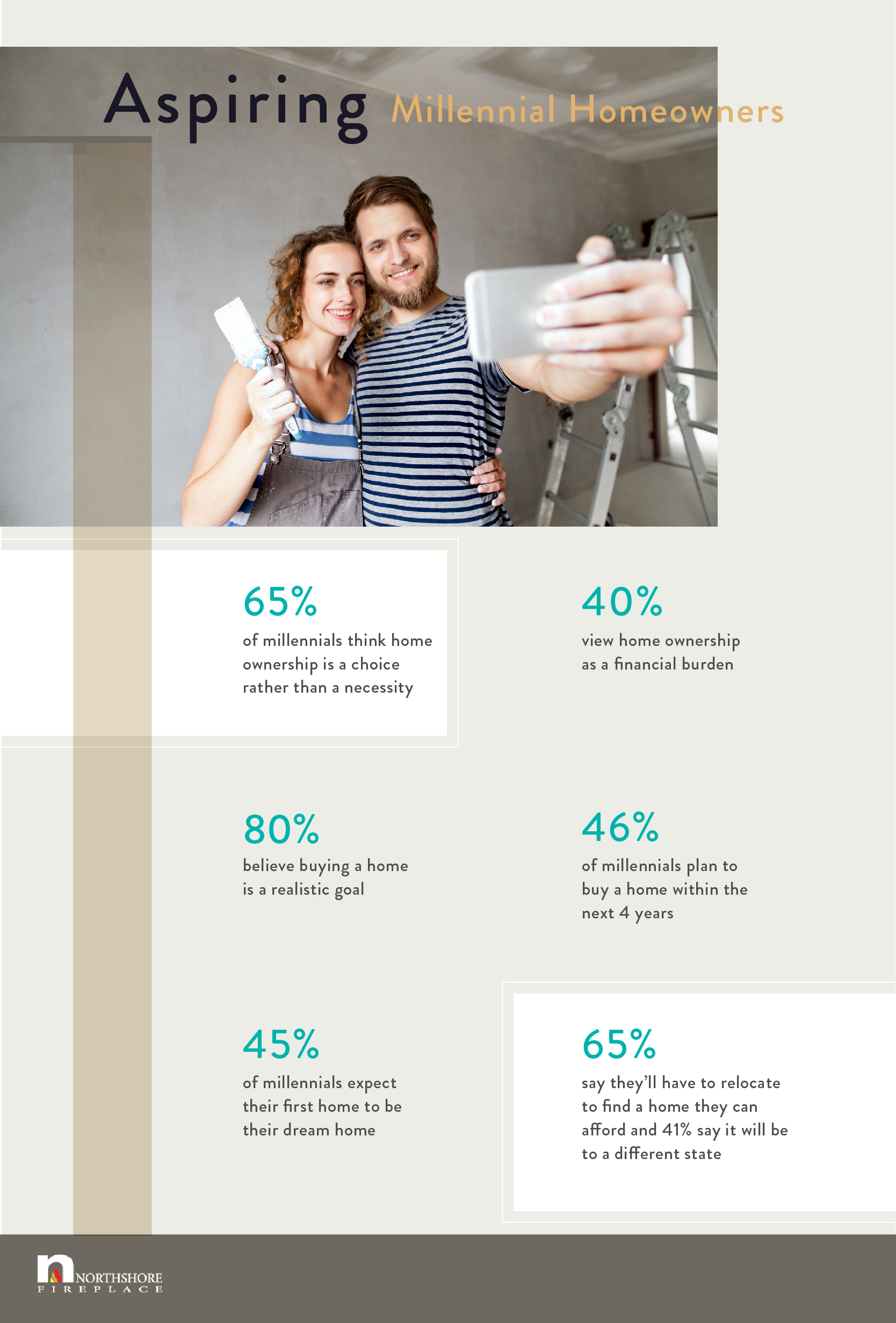

We were also interested in finding out about what aspiring millennial homeowners are looking for in a home. In terms of their current living situation, 20 percent of millennials said they rent and live alone, 26% rent and live with roommates and 20 percent live with their parents. All of these scenarios certainly involve a variety of different experiences, but there were many similarities in our survey results. For example, regardless of their current living situation, 80% of millennials view home ownership as a realistic goal. However, what might not be very realistic is that almost half expect their first home to be their dream home.

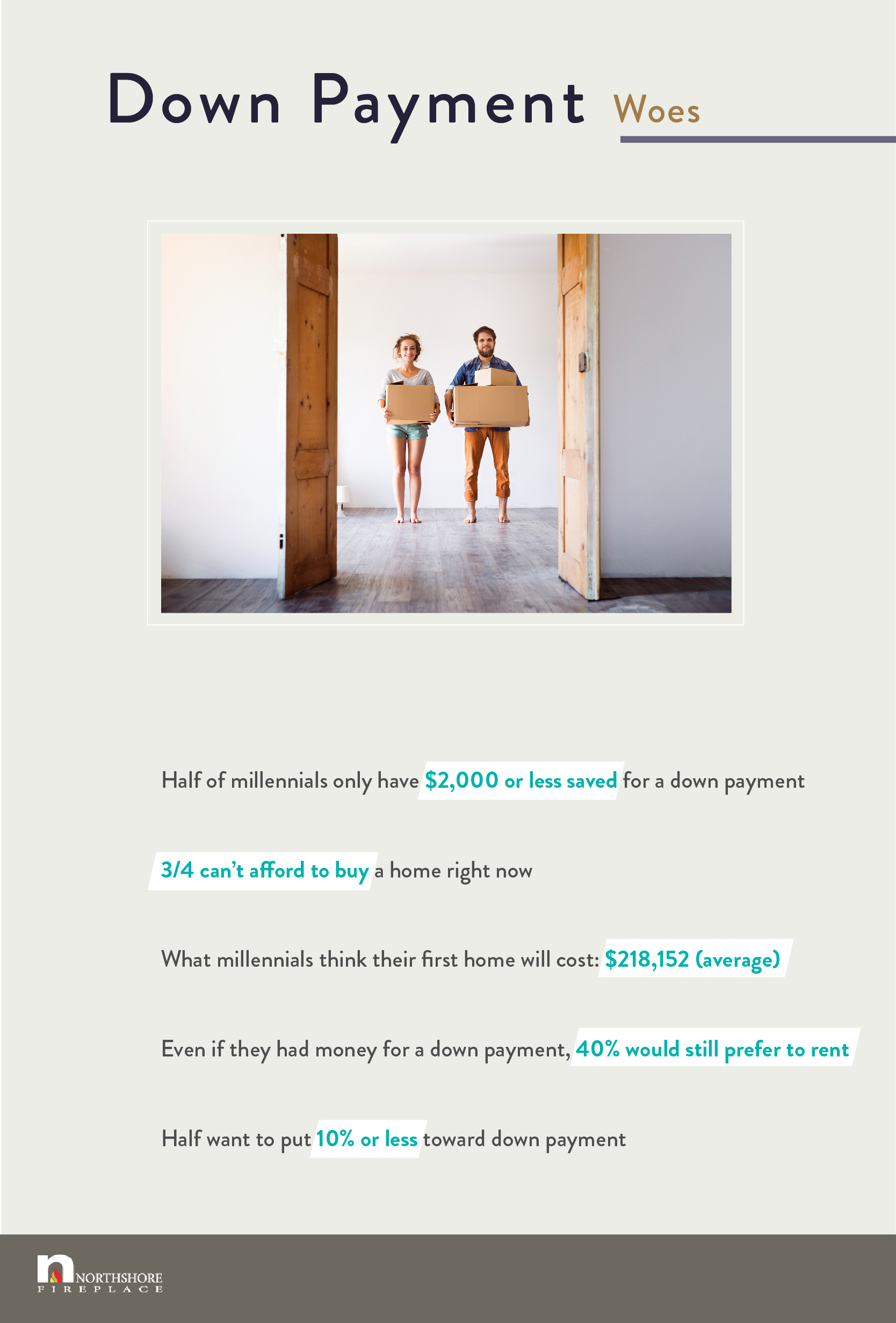

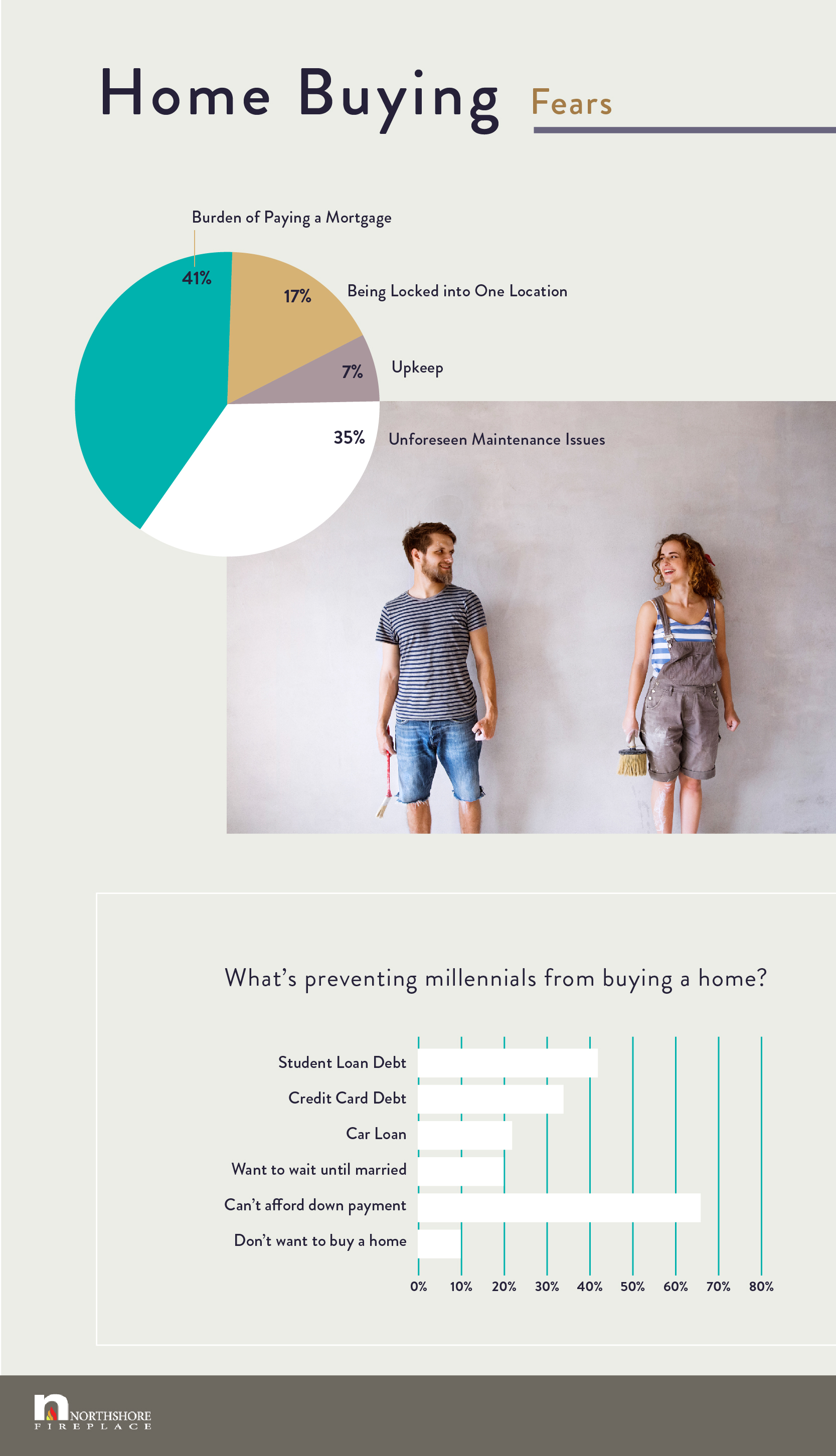

Speaking of realistic expectations, half of millennials currently have less than $2,000 saved for a down payment and 75% say they can’t afford to buy a home. And even if they could afford to buy a home, 40% say they would still prefer to rent. Perhaps they’re waiting for that perfect dream home, or if they’re like 41% of millennials, they might be worried that they can’t afford to make a mortgage payment.

Fears and worries are natural emotions to have when it comes to purchasing a home. Afterall, buying a home takes a giant leap, but it can also pay off immensely. You’re no longer saddled in the endless rent cycle and it also gives you the opportunity to decorate, design and create the home and life you envisioned, which will last for years to come.